There has been increasing concern that the e-commerce world won't be ready for the introduction of "

strong customer authentication" (or two-factor authentication) for electronic and remote payments on 14 September 2019. The checks apply to electronic and remote payments, which include payments online, as well via mobile devices, kiosks or other machines. It is feared many aren't aware of the new checks or the potential that checks will lead to failed or abandoned transactions, causing a hit to retailers' and payment service providers' revenues. The

European Banking Authority now says local financial regulators may provide limited additional time to payment service providers to introduce compliant processes “on an exceptional basis and in order to avoid unintended negative consequences for some payment service users" on that date.

Specifically, the PSPs must have agreed a migration plan with their regulator and execute it "in an expedited manner." The regulator should monitor the execution of the plans "to ensure swift compliance..."

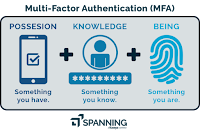

The opinion also contains tables listing the types of features that will (or, in marginal cases, will not) constitute compliant elements for the purpose of SCA (two of either "inherence", "possession" or "knowledge" - i.e. what the customer is, what the customer possesses, or what the customer knows).

There is also guidance on how to satisfy the additional requirements for "dynamic linking" (to ensure the SCA elements link the transaction to an amount and the specified payee when initiating the transaction) and that the SCA elements be independent of each other.

The EBA issued an

earlier opinion and a

Q&A

on how all this applies, but it remains to be seen how many retailers are aware of the new requirements at all, let alone the potential impact on customer experience and 'conversion' (customers dropping out at the payment step when asked to complete one or more additional authentication steps).

Whether payments are affected depends on whether PSD2 applies - some may be out of scope based on currency or location, while others may be within the scope of PSD2 but excluded. There is then a question whether the transaction is interpreted to be one caught by the SCA requirement. Is it remote or electronic and

initiated by the payer (rather than being a 'merchant initiated transaction')? Even transactions that are in scope may not be caught if

the issuer (not the merchant or acquirer) of the payment instrument/account applies any of the potential exemptions:

Low-value transactions: up to €30 per transaction (limit of five separate transactions or €100);

Recurring transactions: e.g. subscriptions for the

same amount and payee (SCA applied to the first transaction);

Whitelisted: payers can add payees to a

whitelist of trusted beneficiaries with the issuer,

but payees can't request this;

Corporate payment processes: dedicated process for non-consumers, approved by the regulator (member

states may exclude micro-enterprises as consumers);

Contactless: up to €50 (limit of five separate transactions or €150 without an SCA check);

Unattended terminals: only for paying transport fares or parking fees;

Low-risk of fraud: as determined by the issuer,

depending on its average fraud levels for the relevant acquirer (not by merchant/channel), with

different limit for cards and credit transfers.

The FCA will apply the SCA standards in the UK even if Brexit occurs.